Fespa Italia, an association that brings together fifty players in the specialised and large-format printing supply chain, conducted a survey between April and May 2023, in collaboration with the Italian magazine PRINTlovers, among Italian print suppliers in the retail world, associated and otherwise, to outline the present and future prospects of the most widely used applications for instore set-ups.

From scenic shop windows, the first touchpoint and real gateway to the customer experience, to signage, from PoP to interior decoration, the research highlights the characteristics of the different applications currently most used, the main choices in terms of media and printing techniques and the demands and expectations of brands specialising in different product sectors and with different distribution models, from single-brand shops to large-scale retail chains. Sustainability data is also extremely important, from production costs to best practices, and the importance of flexible and highly customised printing services.

Sectors and applications

Furniture and design, food, fashion (both high-end and fast-fashion) and perfumery and cosmetics are the sectors that, on average, have the most customers among the printing companies involved in the research, with a predominantly single-brand distribution model. For customers in these and other sectors, PoPs such as corner, free-standing and counter displays (for almost 60% of the companies surveyed), backdrops for scenic showcases, rigid and backlit decorative panels, and window decals are predominantly produced. Wallpapers, horizontal and vertical signage and in-store furnishings are also very important. The various printing applications have an average life cycle of between three and nine months before they need to be replaced with new elements.

Most commonly used media and printing techniques

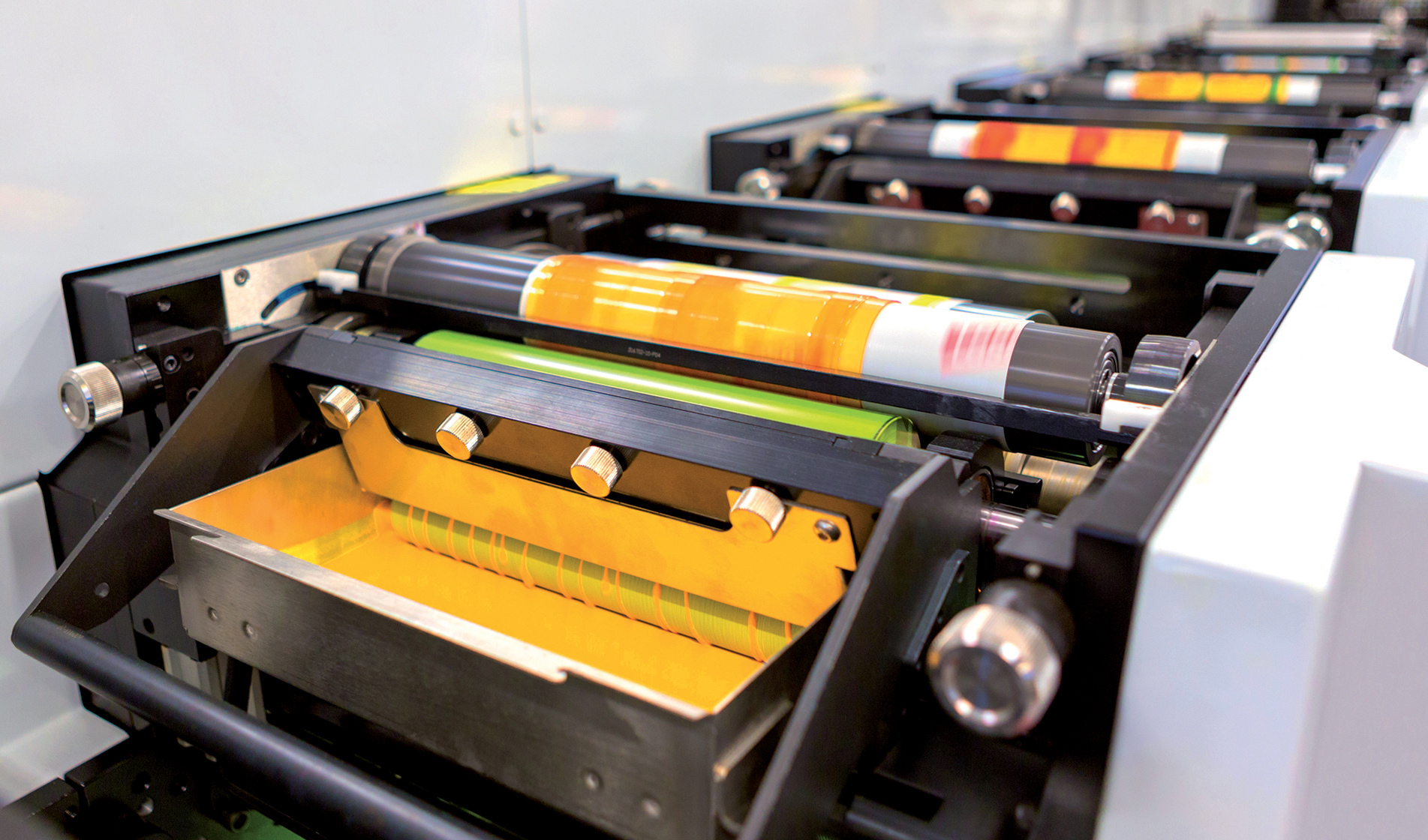

The research reveals that in window display, the most commonly used print medium (19%) is synthetic fabric for soft signage, followed closely (10%) by natural fabrics and corrugated cardboard. As far as furniture is concerned, corrugated cardboard and forex vie for first place, together accounting for 40% of media. Wallpaper is predominantly (37%) on paper, with applications on PVC and synthetic fabrics (16% each) as well. The most used material for PoPs is corrugated cardboard (25%) followed by forex (21%), folding carton and foam board. Finally, the latter material is the most representative (25%) of the decorative panel category. Of the possible printing technologies, digital inkjet accounted for 70 per cent of the total, with UV inks (41 per cent) being popular due to their versatility on different types of media, their print quality and instant drying. The clear prevalence of digital printing makes the offer of the interviewed printers extremely flexible both in terms of print runs and the customisation needs of printed products, which customers require mainly for seasonal offers (67%), but also for point-of-sale differentiation needs based on geographical location (28%) and for the launch of capsule collections or limited editions (24%).

Sustainability: expectations and reality

The last area of research focuses on is the intentions and actual actions of brands with regard to sustainability: it emerges that while 78% of customers ask printers for environmentally sustainable solutions, only 24% of them are willing to spend more for them once they receive a quote. This is because the cost compared to 'traditional' media and printing solutions increases on average by 21.5 per cent, with the range varying between 0 and 50 per cent depending on the application. The only printer/converter that does not detect price fluctuations exclusively produces and prints corrugated cardboard. Furthermore, 29% of the respondents' customers are actively concerned about the end-of-life of printed materials and manage it in a sustainable manner; 43% of the companies that make sustainable choices in the supply of printed materials communicate this to the public; finally, 38% of the printers surveyed currently offer customers a take-back and disposal or recycling service for the printed materials they have supplied.